Is an EPC rating important?

Is an EPC rating important? The Energy Performance Certificate rating (EPC) of a property remains a relatively low priority among prospective homebuyers, according to research from NatWest and IHS Markit.

But with the newly proposed EPC regulations fast approaching, it is becoming increasingly important for rental properties to refurbish and become more energy efficient.

How do I get a good EPC rating?

Each property should have a valid property EPC rating, they need to be renewed every 10 years. You can issue a new energy certificate for your home by visiting the government website.

If your property has an EPC rating of F, G or E, you’ll be expected to make energy efficiency improvements required to reach an EPC rating of C by 2025 unless your property is exempt.

To improve your current EPC rating there are various measures you can take, you can start with the recommendations report included in your EPC rating which should list any of the energy efficiency measures recommended for the property.

We have also created a step by step guide for landlords that lays out clear actions you can take to get a good EPC rating.

What should an EPC rating be?

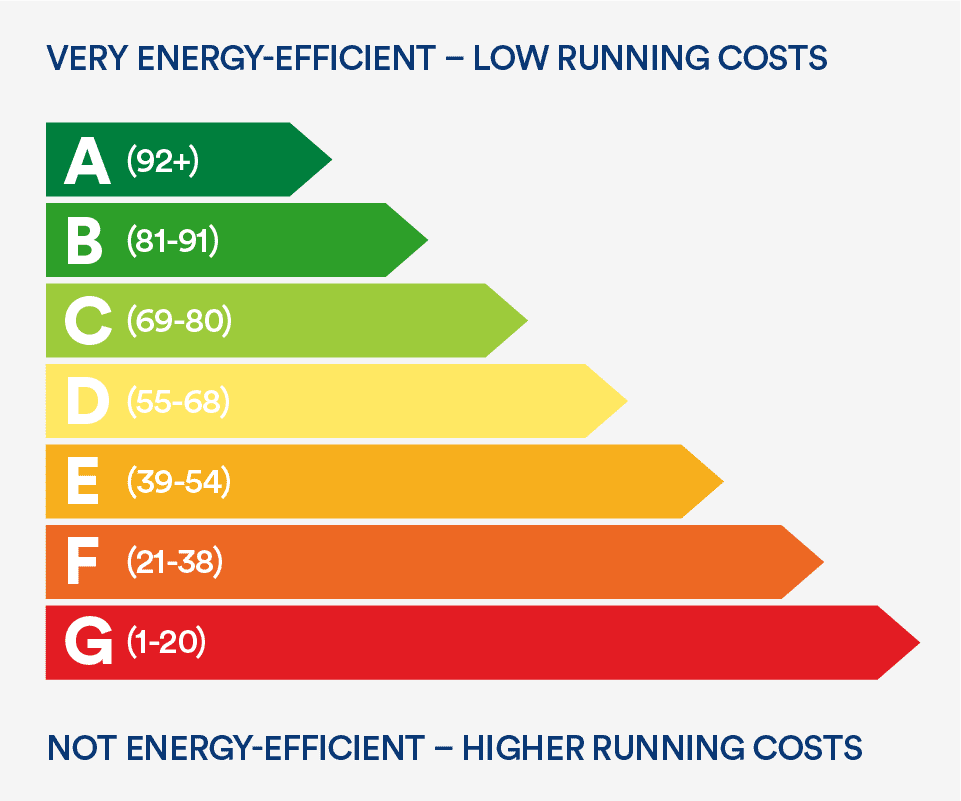

For an EPC the better the rating, the more energy efficient the building is, and the lower the fuel bills are likely to be.

Each energy efficiency rating is based on the characteristics of the building itself and its services (such as heating, ventilation, and lighting).

This type of rating is known as an asset rating. The asset rating will reflect the age and condition of the building.

As of 2022, your rental property needs to have at least an EPC rating of E, but from 2025 this will be increased to a minimum of C which is why it is probably best to get ahead of this and work towards a C rating.

Is an EPC rating important?

An EPC is required when a building is constructed, sold, or rented out. From 2025 new rules mean rental properties with an EPC rating of D, or below, will not be able to take on new tenants.

Property advertisements must include some description of an EPC rating or the certificate itself. A poor EPC rating may not only devalue your property, but it could even make it unsellable.

By ensuring that your properties meet EPC C or above, you will be providing a more energy efficient home for your tenants, as well as helping to reduce energy bills, making your rentals more of an attractive proposition.

What EPC rating is illegal?

The requirement for an EPC has been the law since 2008 and changes came into effect when the Minimum Energy Efficiency Standards (MEES) Regulations were introduced by the government in 2018.

This means that if the property is rated below an ‘E’, the landlord must make the necessary energy-saving improvements and a new EPC is required to prove that the property meets the minimum requirements.

It is now unlawful for a landlord or agent to rent out a domestic property with an EPC rating of F or G, unless they have a valid exemption in place. Landlords may face a penalty fine of up to £30,000 if they fail to meet the minimum efficiency requirement unless there is an accepted exemption.

Why act now?

While the 2025 deadline is still some time away, there is an incentive for landlords to undertake this work now due to the ever-increasing lack of skilled labour in the market, while also considering their options for exit strategies and re-mortgaging with green mortgages which reward those (with cheaper rates) with energy efficient properties.

Financial help to fund the new EPC regulations

Savills’s research has shown that the average cost of increasing a D rated property to a C would be £12,746; from an E to a C would cost over £17,000, and from a G to a C would be nearly £27,000.

This can be a lot for landlords to invest, particularly if you are a portfolio landlord with multiple properties to refurbish. Which is why Newable Finance have now launched an EPC funding solution where you can access £10,000 to £20m.

How Newable Finance can help

The Newable Finance team boast a combined experience of 300 years, you can be rest assured our advisory team will work with you to find the best finance for your needs, providing advice on your portfolio.

With our quick finance, outstanding communication and free independent advice, you can trust us to get you the most competitive deal on the market.

Find out more about EPC funding.